Dr. Thrassy N. Marketos, is a writer – analyst in Eurasia geopolitics. He works for the Hellenic Ministry of Foreign Affair, and is a lecturer in the Athens, Greece branch of the Diplomatic and Strategic Studies Centre (C.E.D.S. – Paris).

Abstract

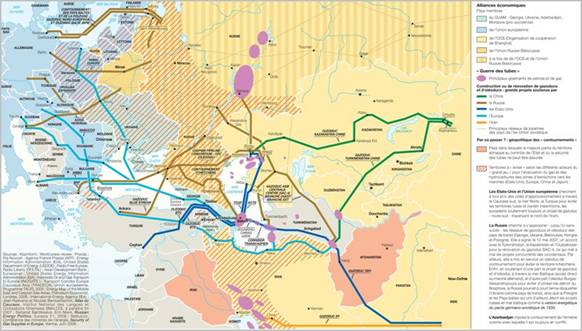

For reasons both of world strategy and control over natural resources, the US administration is determined to secure for itself a dominant role in Eurasia. The Eastern Caspian shore of the Central Asian states of Kazakhstan and Turkmenistan is crucial to the oil and gas control flow, because which of the two major projects – the Trans-Caspian Corridor plus Nabucco pipeline, or the Prikaspiisky and South Stream pipelines – reaches the European market, will in effect determine which major power – U.S., Russia, or China – will gain geostrategic control over Eurasia. Even more seriously, it may determine a new eventual decision of Europe and the rise of a potential big continental power or a coalition of powers threatening the U.S. and the West as a whole, such as a Russian-Chinese alliance empowered enough to control Caspian Sea resources.

Keywords: Caspian Sea, energy resources, transportation routes, United States of America, Europe, Russia, China.

Introduction

The considerable oil and gas resources in the Caspian region, primarily in Azerbaijan, Kazakhstan, and Turkmenistan, constitute the most accessible alternative energy supplies for Europe. Especially in terms of gas, Russian resources are unlikely to fill future European demand due to a lack of domestic investment in new energy projects and infrastructure. It is thus nearly certain that significant amounts of oil and gas from the region will reach the European market in the near future. The question is through which supply routes this will take place; either through Russia directly or through the East-West corridor bypassing Russia to the south. A major problem in consolidating independent (i.e. not reliant on Russia) transit routes to Europe, envisioned by the U.S. as an East-West Energy Corridor through the South Caucasus and Turkey, lies in securing sufficient energy supplies from Kazakhstan and Turkmenistan on the eastern shore of the Caspian Sea.

Nevertheless, for Caspian natural gas to reach Europe in significant amounts, considerable infrastructure development is required. Since Azerbaijani gas deposits have proven insufficient to satisfy European markets in the long term, access is needed, above all, to bring the considerable natural gas reserves of Turkmenistan across the Caspian Sea and on to Europe. The U.S. administration suggests that a successful implementation of EU and U.S. sponsored projects, such as the Nabucco and Trans-Caspian pipelines, would provide the infrastructure needed for bringing significant amounts of Turkmen gas across the Caspian Sea and on to Europe through pipelines independent from Russia.

There is, however, a clear risk that these projects will fail to materialize, especially as a result of the so far rather successful Russian strategies for counteracting them. Russian energy strategy is based on the principle of, as far as possible, gaining control over Central Asian resources, implying control over energy production and transit, as well as gaining stakes in infrastructure and energy companies downstream in Europe.1

Russia has sought to counteract independent European access to Caspian energy in several ways. First, through its energy monopoly Gazprom, Russia has secured long term contracts with Kazakhstan and Turkmenistan for purchases and exports of these states’ energy resources through the Russian pipeline network. This relationship was consolidated by the agreements made during President Putin’s trilateral meeting with Kazakh and Turkmen presidents Nazarbayev and Berdimukhamedov in May 2007, granting Russia increased control over Kazakh and Turkmen energy exports to Europe. As the practically sole outlet for Central Asian gas, Russia is able to purchase cheap gas from these states which is utilized for domestic consumption, thus freeing up Russian gas for export to Europe, often at twice the price.

In addition to Russian efforts to control exports of Central Asian energy exports, Russia has taken the lead in forming an intergovernmental gas cartel through the Gas-Exporting Countries Forum, the first steps toward which were taken at a meeting in Doha in April 2007. The formation of such a cartel would consolidate Russia’s dominance as a gas exporter, allow Russia an even larger degree of control over European energy supply, and would likely help Russia to manage and limit future Iranian competition on the European market.

Second, Russia is seeking to provide new infrastructure for energy transit to Europe from the Caspian, which is aimed at reducing the rationale for projects such as Nabucco, which would connect the region’s resources to the European market through Turkey, and the Trans-Caspian pipeline. For oil, the Burgas-Alexandroupolis pipeline constitutes a competitor to the Baku-Tbilishi-Ceyhan pipeline (BTC) and is fueled through tanker traffic across the Black Sea, from Russia’s port of Novorossiysk, to the Bulgarian coast. The Blue Stream gas pipeline, running north-south under the Black Sea between Russia and Turkey, is intended to compete with the South Caucasus Pipeline (SCP); however it has so far not been running at full capacity. Two other Russian projects have been proposed with the intention of competing with the Nabucco project. These are the Blue Stream II, effectively an extension of the Blue Stream for supplying gas to the Balkans, and the South Stream, planned to run under the Black Sea from Russia to Bulgaria. South Stream thus also conforms to Russia’s strategy of as far as possible reducing its dependence on transit states such as Turkey (through Bosporus and Dardanelle straits) and Ukraine, following a similar logic as the proposed Nord Stream pipeline to Germany to be built under the Baltic Sea.

Third, the EU’s inability to unite around a common energy strategy is allowing Russia and Gazprom to secure European energy demand through buying majority shares in European energy companies, and striking bilateral deals with individual EU states.

Also crucial for the region’s energy configuration is the willingness of Kazakhstan and Turkmenistan to commit their energy for export to Europe. In this regard, Kazakhstan is pursuing an export strategy based on multiple routes. Especially as output from the Kashagan field rises, Kazakhstan needs to find new routes for its oil exports. This can be done through three options: expanding the existing Caspian Pipeline Consortium pipeline (CPC) running west through Russia to the Black Sea coast; feeding additional oil into the BTC pipeline; and exporting eastward to China through a new pipeline that is currently under construction. Kazakhstan will thus be in a position where it can adjust its exports between these three channels, thus granting Kazakhstan greater sovereignty and room for manoeuvre.

Turkmenistan has made long-term agreements to export its gas through Russia, but is also seeking to diversify its export routes. The development of a Trans-Caspian gas pipeline has long been hampered due to discoveries of natural gas in Azerbaijan’s Shah-Deniz field and Turkmen-Azerbaijani disputes over the demarcation of the Caspian Sea; however, recent developments suggest that these states may be moving closer to resolving their differences, thus potentially removing a major obstacle to the Trans-Caspian gas pipeline. Turkmenistan has recently also explored possibilities of exporting gas to China, as well as to Pakistan through Afghanistan.

The energy strategies of Kazakhstan and Turkmenistan present both opportunities and challenges for EU diversification strategies. On the one hand, if serious commitment can be provided for the Nabucco and Trans-Caspian pipelines, the EU and the U.S. policy in Eurasia would stand a good chance of securing a significant share of the energy exports of these states. On the other hand, Russian and especially Chinese competition for these resources is likely to pose significant challenges to the strategies of the West. The outcome of this geostrategic competition will finally determine the major power that will be granted control of Eurasia.

This paper is organized in three sections. In the first part, we shall see how the Kazakhstani government has sought to cooperate with Russia, the US and China in dealing with its energy resources exporting routes. In the second part, we shall examine the significance of the Eastern Caspian sea-shore states for determining the outcome of the Caspian Sea energy projects, and in the third one, the geostrategic battle for the control of Eurasia between the world’s main geopolitical actors under the pretext of Caspian Sea energy transportation projects shall be assessed.

Kazakhstan’s Energy Cooperation with the Main Geopolitical Actors in Central Asia

The Central Asian states themselves have sought to follow a balanced foreign policy vis-à-vis the main actors in the region. This is particularly true in the case of Kazakhstan, a state that is playing a major role in Central Asia energy geopolitics. Of course, this is not a mere coincidence; Kazakhstan, thanks to its large territory and population, vast energy wealth, relative political and ethnic stability, and skilful diplomacy, has emerged as a leader of efforts to promote regional economic and political integration in Eurasia. Astana has also remained committed to a “multi-vector” foreign policy that seeks to maintain good relations with Russia, China, Japan, the United States, and the European Union as well as other countries with important economic, political, or other roles in Eurasia.

In particular, Kazakh officials have sought not to antagonize Moscow, as they have cultivated ties with other countries. They normally take care to emphasize the positive dimensions of the mixed cooperative-competitive energy relationship between Kazakhstan and Russia. Although both countries sell oil to European and Chinese consumers, Nazarbayev insists that he sees Kazakhstan and Russia as energy partners, not competitors. Even though Kazakh officials have continued to express interest in undersea pipelines which avoid Russian control, and have relied heavily on Western energy firms to provide the technologies to exploit Kazakhstan’s vast but difficult-to-access offshore oil resources, they have regularly assured Russian energy firms active participation in any multinational consortium operating in Kazakhstan.

In practice, overlapping energy dependencies require Kazakh-Russian collaboration in this as in other areas. Astana still needs access to Russian energy pipelines to reach many consumers in Europe, while Moscow relies on imports of Central Asian gas—some of which passes through Kazakhstan—to meet its domestic demand and free up Russian energy supplies for export to Europe. For the past decade, Russia has profited immensely by being able to buy Central Asian energy supplies below market prices while selling oil and gas to foreign customers at much higher rates, yielding Russian energy players a hefty mark-up.

Russia values the genuinely friendly and mutually advantageous relations with Kazakhstan. In April 2006, the two countries signed an accord to increase the volume of Kazakh crude oil transported through the CPC, which extends from the Tengiz field in western Kazakhstan to the Russian port of Novorossiysk, to 67 million tons annually by 2012.2 Russia’s state pipeline monopoly Transneft has a 24% stake in the CPC—which was commissioned in 2001 as a joint project of Gazprom, Lukoil, and Yukos—while Kazakhstan owns a 19% share.3

In May 2007, the Kazakh, Russian and Turkmen governments also agreed to construct a major new natural gas pipeline whose route would wind around the Caspian Sea from Turkmenistan through Kazakhstan to Russia. Although the planned Caspian gas pipeline is scheduled to enter into service in 2011, the details of this arrangement remain under negotiation. Kazakhstan is supposed to contribute half of the volume, while Turkmenistan will supply the remainder.4

These oil and gas pipelines are seen as the main competitors for those backed by Western governments that would circumvent Russia by crossing under the Caspian Sea. The Russian government has objected to the development of such underwater pipelines until the littoral states resolve the Caspian Sea’s legal status. Moscow has also raised concerns that undersea pipelines could cause environmental damage. This deadlock has thus far ensured that Kazakhstan and Turkmenistan send most of their oil and gas northward overland to Russia.

This is particularly harmful to the U.S. geostrategy in the region. Although some estimates of the probable recoverable energy resources in the Caspian have declined during the Bush administration, American officials have continued previous U.S. efforts to ensure that Kazakhstan exports at least some of its energy production westward through the South Caucasus. In particular, American policy makers launched a sustained diplomatic campaign to secure Kazakh participation in the Baku-Tbilisi-Ceyhan oil pipeline. More recently, U.S. officials have sought to get the consent of Kazakhstan to direct some of its expected natural gas exports through the planned Trans-Caspian pipelines. Conversely, Washington has sought to minimize the flow of Kazakh energy products to Iran, pending changes in that country’s foreign policies.

Two factors have primarily limited U.S. influence in Kazakhstan. First, although the United States is a global superpower, it is a distant one from the perspective of Kazakh officials, who are constantly engaged in managing relations with Russia, China, and other neighboring countries. Although Kazakh leaders desire a sustained major U.S. role in Eurasia to provide geopolitical balance as well as economic, military, and other resources, many in Kazakhstan and elsewhere remain uncertain about the durability of the major American presence in Central Asia, which is a relatively new historical phenomenon.5

Second, America’s strong commitment to promoting human rights and democratic principles in Eurasia has irritated some Kazakh officials. Bilateral tensions over the pace of political and economic reforms, as well as allegations of corrupt practices by Kazakh officials and their American partners in the energy industry, have persisted since the country’s independence.6

These issues were totally irrelevant to China’s policy toward Kazakhstan. The Chinese government has sought to increase its economic ties with Kazakhstan and other countries in Greater Central Asia because they see this region as an important source of raw materials, especially oil and natural gas. Chinese policy makers are uneasy about relying so heavily on vulnerable Persian Gulf energy sources. Gulf oil shipments traverse sea lanes susceptible to interception by the U.S. or other navies. In addition, the Chinese government recognizes that terrorism, military conflicts, and other sources of instability in the Middle East could abruptly disrupt Gulf energy exports.

Since Chinese efforts to import much additional oil and gas from Russia have proven problematic, Beijing has strongly pushed for the development of land-based oil and gas pipelines that would direct Central Asian energy resources eastwards towards China. The new inland routes would provide more secure energy supplies to China than existing seaborne links. These burgeoning energy ties have also made avoiding political instability in these countries a concern of Chinese policy makers.

Beijing’s cultivation of energy ties with Kazakhstan has been making steady progress. While retaining a strong presence in Pakistan, Chinese firms have been increasing their investments in new South and Central Asian markets, especially in India and Kazakhstan. The Chinese government has been helping to finance the development of roads, ports, and energy pipelines linking South and Central Asia to China, because significantly increasing Chinese economic intercourse with these regions will require major improvements in the capacity and security of east-west transportation links. Over the past decade, the two countries have been establishing the core infrastructure required by their expanding economic ties—creating border posts, energy pipelines, and roads and railways that have converted the informal shuttle trade that arose in the 1980s to a large-scale, professional economic relationship.7

China has imported Kazakh oil via railroad for a decade. In addition, hydropower plants in China supply about 20% of Kazakhstan’s electricity consumption.8 Western firms were initially able to block the efforts by Chinese energy companies to join Kazakhstan’s largest oil and gas projects.9 But energy cooperation has accelerated in recent years after the Kazakh government fully committed to directing a share of its energy exports eastward to China.

In July 2005, Chinese President Hu Jintao signed a declaration of strategic partnership with Nazarbayev that, among other things, provided for expedited development of the 1,300-km Atasu-Alashankou pipeline to transport at least ten million tons of oil annually from Kazakhstan’s Caspian coast to China’s Xinjiang province.10 This 50-50 joint venture between the Chinese National Petroleum Corporation (CNPC) and KazMunaiGaz began operating on a limited basis in December 2005, marking the first eastward flow of Central Asian oil and China’s first use of a pipeline to import oil. In August 2007, the CNPC signed an agreement with KazMunaiGaz to extend the Atasu-Alashankou pipeline 700km westward, linking China directly to Kazakhstan’s Caspian fields.11 The CNPC has also acquired a substantial stake in a new natural gas field in western Kazakhstan. Chinese oil firms operate four oil fields in the country, and in 2005 purchased Petrokazakhstan, a leading Kazakh energy firm. Sinopec, CNPC, and other Chinese energy firms produce about 13 million tons of oil annually in Kazakhstan.12 Beijing views Kazakhstan’s cooperation with China on energy imports as an important contribution toward realizing its goal of becoming less dependent on Middle East oil supplies.13

The Significance of the Eastern Caspian Sea-Shore States for Determining the Outcome of the Caspian Sea Energy Projects

Among all major geopolitical actors in the Greater Central Asia region, Russia has had the most clear and discernible policy regarding energy resources as relates to both Europe and the region proper. This policy has consisted of a number of facets, all of which have sought to capitalize on energy as the main vehicle for strengthening Russia’s influence over its neighboring regions. The strategy has had several main aspects: state control over the production of gas for export; keeping a monopoly on acquiring Central Asian gas at cheap prices; achieving increasing dominance over the European consumer markets; and utilizing dominance over both the import from and export to CIS countries of gas for political purposes.

On the foreign policy front, the main purpose has been to secure Moscow’s monopoly on the transit of all oil and gas from the Soviet republics to consumer markets in Europe, which is equivalent to securing Russian control over the energy exports of the states of the Caspian region. With regard to non-energy producing former Soviet states, ranging from the Baltic States to Ukraine and Georgia, Moscow has used its continuing monopoly on energy deliveries for political purposes. In trying to overcome the loss of its total monopoly on Western Caspian oil with the construction of the Baku-Tbilisi-Ceyhan pipeline, it prioritizes continued monopoly over Caspian gas from both the western and eastern shores. As far as Azerbaijani gas is concerned, Russia’s monopoly is threatened by the project of the Baku-Tbilisi-Erzurum pipeline (South Caucasus Pipeline), flowing in parallel to the BTC oil pipeline.

However, Moscow has tried to offset the loss of control over Azerbaijan’s oil supplies by seeking to commit the Turkish market to growing volumes of Russian gas supplies. This prospect was greatly aided by the building of the Blue Stream pipeline, across the Black Sea, delivering an eventual 10 bcm or more to Turkey by 2010. The Turkish market is already heavily overcommitted in terms of gas, having committed to supplies from Azerbaijan, Turkmenistan, Iran and Russia, as well as LNG from Algeria and Nigeria that the Turkish market cannot absorb. Turkey’s natural gas consumption, standing at over 20 bcm per year, has grown tremendously in the past decade and is set to grow even further.14 But at present, Turkey has found itself in a situation where Russia supplies ca. 65% of Turkey’s gas.

The building of the Blue Stream pipeline – a 743 mile long, $3.2 billion project – cemented Moscow’s influence on the Turkish gas market. This ensures that Turkey is principally in no position to buy volumes of Azerbaijani gas from Shah-Deniz beyond the Phase One gas supplies from 2007 to 2011. The larger volumes to be produced from 2012 onward can simply not be consumed by the Turkish market, forcing producers to find alternative markets.

Moscow’s strategic goal underpinning Russian gas flow through the Blue Stream pipeline and from there onward to Central European markets is to shut out alternative transit routes from the Caspian region by committing Russian gas to Europe from a variety of transit routes that will fill up capacity that could otherwise be utilized by Caspian producers. It is exactly in this context that the North European Gas Pipeline (Nord Stream) should be seen. This pipeline, to stretch from Russia’s short coast on the Baltic sea across the seabed to Germany, will cost approximately $10.5 billion. This exorbitant cost makes the pipeline much more expensive than a line crossing Ukraine or Belarus, for the very purpose of achieving an export pipeline that does not cross former Soviet countries on its ways to European markets. In other words, Gazprom will be able to cut gas supplies to Ukraine without European customers having to be affected. By the same token, an expanded version of the Blue Stream pipeline would allow Gazprom to commit volumes of gas, probably taken from Central Asia, to European markets – mainly Germany – through Turkey, thereby hindering Caspian gas suppliers from selling gas to European markets independently.15

Yet Moscow’s energy strategy does not stop at this. Beyond seeking to sustain a monopoly on European gas supplies from the east, it is also seeking a greater influence over other alternative supplies to Europe, primarily from Northern Africa. Indeed, Moscow has aggressively pushed for influence over Algerian and Libyan exports to Europe. As Vladimir Socor observes, ‘In Algeria’s case [the third largest gas supplier to Europe], Russia has successfully offered multibillion-dollar arms deliveries as well as debt write-offs in return for starting joint extraction projects in marketing of the fuel in Europe’.16 This and similar Gazprom activity in Libya has led to growing worries that Moscow is seeking to build a gas cartel to control prices to Europe. Indeed, a NATO report leaked in November 2006 indicated that these concerns are taken seriously by western leaders.17

A. Natural Gas Transport Route Propositions

The Caspian alternative to increasing dependence on Russia was implicitly acknowledged by the EU through the realization of the INOGATE project, implying the construction of pipelines that will connect Europe to the gas producers of the Caspian region. This process is already in course – through the integration of European gas transportation networks on the one hand, and the building of a new energy transport infrastructure connecting Azerbaijan to Turkey, on the other hand. As such, there are two major priorities for the realization of the US sponsored East-West corridor: linking the Turkish gas network to the European one; and linking the West Caspian to the East Caspian by Trans-Caspian pipelines. This project, will create a virtual South Caucasian corridor to Europe, and can be complemented – if found economically viable – by a connection linking the South Caucasus to Ukraine across the Black Sea known as White Stream.18

The first project envisions the construction of the Aktau-Baku Trans-Caspian oil pipeline, and of the Trans-Caspian Gas Pipeline linking Turkmenistan with Azerbaijan: two major projects likely to instigate geopolitical competition not only among Russia and the United States, but also China. China’s growing dependency on foreign oil and gas, and its policy to diversify its energy supply routes by using the Caspian region deposits, could eventually lead to tension between Washington and Beijing over their respective interests in the Caspian region.

The Aktau-Baku subsea oil pipeline will allow Kazakhstan to transfer its oil using the existing Baku-Tbilisi-Ceyhan pipeline. As far as the Turkmenistan–Azerbaijan natural gas pipeline is concerned, it will be linked to the Baku-Tbilisi-Erzurum pipeline. Iran and China will be a primary challenge with respect to the Turkmenistan-Azerbaijan gas pipeline, while Russia’s attitude will be crucial for both pipelines.

According to these plans, the Kazakh natural gas will join the Turkmenistan-Azerbaijan gas pipeline, then Baku-Tbilisi-Erzurum pipeline and from there the ‘Nabucco’ pipeline project, which proposes to link Turkey’s borders with Iran and Georgia to the Austrian terminal of Baumgarten an der March, crossing Bulgarian, Romanian and Hungarian territories. The Nabucco pipeline, approved in June 2006, will have an eventual capacity of 25-31 bcm. A feasibility study for this €7.9 billion, 3,300 km pipeline has been completed, and construction for the first phase is set to take place in 2010. At this point, it will be capable of transporting 4.5-13 bcm, with larger capacity expected to follow in 2020.

The second project is the Turkey-Greece-Italy interconnector (TGI), with a capacity of 12 bcm in 2012 delivered to the Italian Otranto terminal. In 2007, a small capacity of less than 1 bcm will be available, though large volumes would have to wait.

White Stream supporters argue that with more than 1.3 trillion cubic meters in reserves in Shah Deniz field, Azerbaijan has ample potential to support the existing Baku-Tbilisi-Erzurum pipeline (BTE) and its planned continuations –Turkey-Greece-Italy (TGI) and first stage of Nabucco- as well as the first string of White Stream. Thus, White Stream project does not compete with BTE or Nabucco for upstream recourses in the first stages of these projects. Of course, in the second phase, the availability of all these pipeline outlets to Europe should require, they admit, major volumes of Central Asian gas.

White Stream pipeline project would branch off from BTE, run approximately 100 kilometers to Georgia’s Black Sea coast near Supsa, and from there follow either of the two options below: the first one would run 650 kilometers to Ukraine’s shore, cross the Crimea from east to west for 250 kilometers, with a possible connection to Ukraine’s mainland pipeline system, and continue under sea for 300 kilometers to the Romanian coast. The second option envisages laying a seabed pipeline from near Supsa in Georgia, running 1,100 kilometers to a point near Constanta in Romania. This long version may require construction of an intermediate floating compressor station in the open sea, of course running a high risk both from the messy weather conditions in winter, and from earthquake-prone Black Sea subsoil.

Source: Le Monde Diplomatique, Philippe Rekacewicz — June 2007

Gazprom, for its part, has tried to derail the Nabucco pipeline. It announced a deal with Hungary, just as Nabucco was approved in June 2006, envisaging to expand the capacity of the Blue Stream pipeline and to extend it via Turkey and the Balkans into Central Europe (Hungary) – apparently in parallel to the Nabucco Pipeline.19 Simply put, Gazprom seeks to pre-empt the building of interconnectors between Turkey and Europe for Caspian energy, by creating a parallel line to transport the exact same reserves – directly or indirectly – but via Russia and under Gazprom ownership.

Gazprom has also signed a memorandum of understanding with the Italian ENI and the Bulgarian Bulgargas to build a gas pipeline from Russia to Italy, labeled ‘South Stream’ (2007). Starting from Russia’s Black Sea coast at Beregovaya, South Stream would run some 900 kilometers on the seabed of the Black Sea, reaching a maximum water depth of more than 2,000 meters, to Bulgaria. Two options are considered from there. The south-western would continue through Greece and the Adriatic seabed in the Otranto Strait to southern Italy. The northwestern option would run from Bulgaria through Romania, Hungary, and Slovenia to northern Italy. Gazprom is holding out all options, including that of building both.

The new pipeline is intended to carry 30 billion cubic meters of Siberian and Central Asian gas annually, and marks, along with the North Stream project, Russia’s policy to reduce overland transit through neighboring countries, relying increasingly on maritime transportation for its energy exports to Europe.20 Blue Stream extension and South Stream are intended to circumvent Ukraine and Turkey, both transit countries.

South Stream can partly change the original destination of Blue Stream extension, with the throughput volume rerouted southward across Anatolia for shipment to Israel.21 Either project would be a rival to the EU and US-backed Nabucco and Baku-Tbilisi-Erzerum gas pipeline through Turkey, which is planned to either be integrated with Nabucco or run from Turkey to Greece and Italy. The inter-state gas pipeline TGI –more precisely the Greco-Italian sub-sea junction called ‘Poseidon project’- and the private gas pipeline TAP (Trans-Adriatic-Pipeline), which will follow the same route as TGI to the Central Macedonia region in Greece, and then continue to Albania and Italy through the port of Vlore, make Greece the crucial junction country for two gas pipelines not controlled by Russian interests.

The US arguments against South Stream project – that it increases Europe’s dependence on Russian imports, and that it diminishes the availability of alternative natural gas recourses from Central Asia (Turkmenistan, Kazakhstan) which could be channeled to the Nabucco or TGI projects – can be overruled for the following reasons: A) the Azerbaijani gas resources alone do not suffice for satisfying European demands for gas, B) Washington, while aiming to avoid Russian soil for the transport of the energy resources, is totally negative towards the participation of Iran, which is the only natural gas producing country capable of substantially threatening Russia’s predominant position, C) Washington’s interference in the Ukrainian political crisis destabilizes European gas imports, because it accelerates inter-Ukrainian and Russian-Ukrainian tensions. The possibility of a major crisis in Russia–EU energy relations is most likely to be produced by a sabotage in the Ukrainian gas distributing system in the case of an open dispute between the conflicting camps in the country, rather than by a Russian embargo on natural gas exports.22

Washington’s argument that energy imports from Russia pose an eventual political risk for Europe is not proved by history, for the simple reason that Russia always valued the source of its exchange deposit (estimated today equaling to 25% of the Russian GNP and 50% of its budget income).

Referring to both strings of the North European Gas Pipeline from Russia to Europe, Jonathan Stern of the Oxford Institute for Energy Studies explains:

“These two pipelines will reduce dependence [of Europe] on Ukrainian transit routes, at least until such time as total Russian exports require all available transport capacity to be utilized. However, if Russian–Ukrainian gas relations fail to show sustained improvement, the NEGP may simply be a partial replacement of Russian export capacity via Ukraine, rather than additional export capacity. The same reasoning may be applied to the South European Gas Pipeline (SEGP) which is envisaged as a westward extension to Blue Stream providing a route to south eastern Europe, possibly as far north as Hungary, avoiding Ukraine.”23

Indeed, South Stream, a pipeline estimated to cost €10 billion, is going to be a pipeline made by Russia, which will transport almost exclusively Russian and possibly in inferior amounts Central Asian –Turkmen, Kazakh and eventually Uzbek – gas. Most importantly, this pipeline project is not going to be dependent on Azerbaijani, Iranian, Iraqi or Egyptian gas, or from any other potential source necessary for feeding Nabucco or TAP or TGI projects’ operation.

South Stream bypasses Turkey, and thus Ankara loses the role of the central transit station in the way of the Russian and Central Asian natural gas to Southern and Central Europe, a highly desired role and one that was generously sponsored by Washington. In other words, Russia will possess a double route for exporting its gas: through Turkey and Greece, and through Bulgaria and Greece. Evidently, the gravity centre of the safe energy provision of Europe is moving toward Greece, a member-state of the EU, enjoying both political and economic stability. For that reason, Moscow seems to have begun treating Athens as a strategic partner. The Kremlin counts on Greece’s stable political and economic system, its political, and most importantly, economic hold-outs in the Balkans. These ones could play the role of Russian business investments supporting their network in the 65 million consumer’s Balkan market. Moscow focuses also on Greece’s possibility to develop into an energy and trade transit road and railway centre, which could permit binding the Russian Black Sea ports to Thessaloniki and the wider Mediterranean region.

On the other hand, South Stream also avoids Ukraine and the other East European countries that are leaning toward Washington in their foreign relations (the Baltic countries and Poland). In Russian view, this avoidance is estimated to be mostly beneficial for Russian–EU relations.

In another most serious event, Russia seems to have gained Kazakhstan’s support in Moscow’s energy strategy in Central Asia, giving it a powerful hold over this region’s energy resources. In a two phased summit in Astana and Turkmenbashi (May 12, 2007), Russia, Kazakhstan and Turkmenistan agreed to modernize and expand the capacity of the Central Asia gas transport system (the Prikaspiiski natural gas pipeline) with its two components: the truck line along the Caspian coast, Turkmenistan-Kazakhstan-Russia; and the other, larger truck line, detouring from Turkmenistan to Uzbekistan. Astana also agreed to supply 8 billion cubic meters annually to Gazprom’s processing plant at Orenburg in Russia, turning it into a Gazprom-operated joint venture, which will process growing volumes of gas from Kazakhstan for delivery to Europe through Russian soil. Finally, the three states, along with Uzbekistan, agreed to refurbish two additional natural gas pipelines.

When all the works are completed, Russia stands to almost double its imports of Central Asian gas to roughly 90 billion cubic meters, up from the present level of about 50 bcm.24 To demonstrate their commitment to the project, both Turkmenistan and Kazakhstan agreed to finance construction of their respective portions of the pipeline without Russian assistance.

Under the Prikaspiiski pacts, a coup de grace is delivered against the Trans-Caspian pipeline (TCP) project, blocking the efforts of Russia’s rivals to create alternative energy-supply routes that the Kremlin cannot control. The deals have also dashed the wishes of several Central European post-socialist countries of breaking their energy dependence on Russia.

Some hope for the rescuing of the Nabucco project could come from the memorandum of understanding (MoU) on gas deliveries from Turkmenistan through Iran to Turkey and from there to Europe, signed by the Turkish Energy and Natural Recourses Minister and his Turkmen and Iranian counterparts (Ankara, 13.07.2007). This deal, if finalized, could a) open the last available gas corridor to Europe (‘fourth corridor’), b) give Turkmenistan an overland outlet to Turkey and further afield, circumventing the Caspian Sea instead of crossing it, c) provide direct access for Iranian gas westward, diversifying the EU supplies away from dependence on the Russian Gazprom, and d) put some counter-leverage into European hands ahead of 2010, when some major supply agreements with Gazprom will be up for renegotiation.

Under the MoU, 30 million cubic meters of gas would enter Turkey annually from Iran and from Turkmenistan via Iran, giving Turkey a chance to become a gas-trading country, rather than a gas-transiting one, at least for a part of the volumes involved. It maintains also the opportunity to integrate the Baku-Tbilisi-Erzerum pipeline for Azerbaijani gas with the Nabucco project.

In addition, as both Turkey and Greece signed separate agreements with Teheran for the purchase of large amounts of natural gas from Iran, Turkey has conveyed to Greece Iran’s interest for the interconnection of both country’s’ networks with the Iranian one. Washington itself is conveying to both countries its refusal to accept an Iranian intervention, while Moscow seems to work on this issue closely with Teheran.25

B. Oil Transportation Route Propositions

In another event of major importance, Russia, Greece and Bulgaria signed an international agreement to build the Trans-Balkan oil pipeline, Burgas-Alexandroupolis. The pipeline’s rationale is to provide a second outlet from the Black Sea, circumventing the overcrowded Bosporus and Dardanelle straits, for Russian oil and Russian-loaded Caspian oil en route to the open seas. Transneft, GazpromNeft, and Rosneft hold a combined 51% stake, with Transneft as project operator. The Greek and Bulgarian governments hold the remaining 49%, with the right to sell portions of their stakes to international or Russian oil companies that would use this transit pipeline.

As this 35 million tons annual capacity pipeline – with expansion to 50 million tons in a second phase – will in effect become a prolongation of the Caspian Pipeline Consortium’s (CPC) line from Kazakhstan to Russia’s Black Sea port of Novorossiysk, it constitutes direct rivalry to the US backed oil transport projects from Kazakhstan westward, such as the Aktau-Baku trans-Caspian oil pipeline, Baku-Tbilisi-Ceyhan (BTC), the Odessa-Brody pipeline in Ukraine and its possible extension into Poland, as well as the pipeline running from Turkey’s Samsun port to Ceyhan.

Proceeding with Burgas-Alexandroupolis and a commitment to its use by Western companies working on Kazakh oil fields are preconditions to the planned enlargement of the CPC pipeline from Kazakhstan. The US, European, and Kazakh oil companies faced production delays and financial losses due to Moscow’s blocking of that pipeline capacity expansion for the last three years. Russia demanded that these companies commit that the oil for CPC was indeed routed through Russia, rather than across the Caspian and the South Caucasus.

Finally, in the context of the Prikaspiisky Pacts, Russia and Kazakhstan have announced their intention to expand the CPC pipeline, up from its present capacity of 23 million tons annually to 40 million tons. Kazakhstan also agreed to supply up to 17 million tons of oil per year for the first-ever Russian state-controlled pipeline operating on EU territory – the 280 kilometer Burgas-Alexandroupolis project. 26

The Burgas-Alexandroupolis project will also affect the Baku-Ceyhan system, since the latter requires significant additional volumes of Kazakh oil even in a short-to-medium term perspective, within less than a decade’s time. The same applies to the Odessa-Brody-Plock (Poland) project, since it ensures long-term use by Russian companies north-south, instead of the originally intended south-north use for Caspian oil to Europe In addition, future users of the Burgas-Alexandroupolis pipeline will have to negotiate with Russia’s state pipeline monopoly Transneft regarding the oil volumes and schedules for using this pipeline. This means that the US and European companies will depend on the Russian state for accessing EU territory to transport oil extracted by Western companies.

The reasons behind Moscow’s advocacy are connected to Kazakhstan’s increasing attraction to the American and European sponsored BTC feeding project that was scheduled to bypass Russian territory, on the one hand, and the linkages between Kazakhstan and Central Asia, on the other. Another motive is that Russia is concerned about becoming too dependent upon Turkey as a transit route or middleman for the export of its energy products to Europe. It is noteworthy that one third of Russian exports go through the Bosporus and a large amount of gas goes through the Blue Stream pipeline and Turkish soil to Europe. Evidently, Turkey’s ability to close the Bosporus could cripple Russian exports in general, or force Moscow to accept the BTC exporting system.

The American administration, in order to avoid the implementation of the Burgas-Alexandroupolis pipeline project, proposed a trans-Balkan pipeline that crosses Bulgaria (Burgas), the Former Yugoslav Republic of Macedonia (fYROM), the area of Kosovo and ends in the Albanian port of Vlore, a project known as AMBO. In December 2004, under American guidance and financial support Bulgaria, Albania and FYROM signed a memorandum of understanding for AMBO pipeline construction. This project, 912 kilometers long will cost 1.3 billion US dollars, but is proposed in parallel to a wider infrastructure works program, including a trans-Balkan highway, a natural gas pipeline and a fiber optics network running in the same direction as AMBO. By this scheme, Washington aims to include the above mentioned countries in its network of influence, in addition to the US military bases and other facilities located there.

Of course, any practical move on this project is conditioned on the outcome of the situation around Kosovo, which has become a major issue of dispute between the United States and the Russian Federation, which used to be a highly influential country in the Balkans.

South Stream Project Versus Nabucco Project: Who is Gaining the Geostrategic Control of Central Eurasia – Russia, the West (U.S. and E.U.) or China?

As analyst Zeyno Baran puts:

“For Russia, the main purpose of the South Stream gas pipeline project is to prevent Nabucco and TGI from transporting Caspian gas directly to European markets without its involvement. Its main tactics in accomplishing this goal are twofold: first, locking up the markets and keeping out potential competition and second, ensuring a long-term and large-volume gas commitment from Turkmenistan (as well as Azerbaijan, Kazakhstan and Uzbekistan) to its pipelines, thereby preventing a direct Caspian-Europe connection because of lack of access capacity”.27

By signing the Prikaspiisky Pacts with Turkmenistan and Kazakhstan Russia intended to bring those countries’ gas volumes north into the existing Gazprom infrastructure, as a way to frustrate attempts to bring Central Asian gas westward. It is a direct threat to the ability to bring offshore Turkmen volumes west, which is the real and practical way of supplementing Azeri gas for delivery into the Nabucco pipeline project.

Azerbaijan has agreed to supply Nabucco’s first phase with 8 bcm; according to plans, in the second phase, gas from Central Asia should enter the pipeline, while in the third stage, gas from Iraq and Iran, and possibly Egypt, would flow into Nabucco onwards to Europe. This is why large-scale gas production in Azerbaijan is contingent on direct access to European markets. If Azerbaijan can obtain this, then its gas will flow westward, and Europe will have gas supply diversification. If not, then the gas will stay in the ground; Gazprom’s pressure on Central Asian producers will increase; and subsequently, the westward movement of all gas from Central Asia will take place exclusively through Russian-controlled networks—ensuring that no diversification can happen.

Zeyno Baran adds that: “…South Stream directly competes with Nabucco—the two pipelines target the same markets and utilize almost identical routes. In fact, three of the five countries along Nabucco’s route are also part of South Stream’s intended route”. Furthermore, “Nabucco faces a number of financing hurdles even in the absence of South Stream. Investors are uncertain that a Trans-Caspian gas pipeline will be constructed to bring in the Turkmen gas that many view as necessary for the success of Nabucco. The possibility that South Stream will be constructed and will meet a significant portion of consumer countries’ expected short-to medium-term demand will likely be enough to deter investors from Nabucco”. Another point is that “Nabucco will be privately financed and therefore needs to be commercially viable, whereas South Stream is backed by the state-owned Gazprom, which is perfectly willing to finance projects that do not make commercial sense so long as they support the strategic goals of Moscow”.28

In order to win over Bulgaria as well as Greece, the Russian side offered to back the Burgas-Alexandroupolis oil pipeline between Bulgaria and Greece that both countries greatly desire. The Burgas-Alexandroupolis pipeline was competing with the Turkish Samsun-Ceyhan project for the potential transport of oil from the Black Sea to the Mediterranean; Russia was thus also able to play Bulgaria and Turkey against each other. And on gas, Russia decided to bypass Turkey with South Stream. Moreover, by reaching the Greek market first, Gazprom could seriously undermine TGI, thereby preventing any Caspian gas from reaching EU territory via Turkey. As TGI could provide Greece with half of its gas needs, this would also be a serious blow to Athens’ gas diversification efforts.

Hungary, Greece and Bulgaria thus became EU member countries which allied themselves with the Kremlin and Gazprom against the common European interest of diversification. Vahid Alekperov, president of the Russian oil giant Lukoil, as early as 2001 revealed the thinking behind the Kremlin’s strategic energy plan: “Bulgaria, whose oil sector is almost entirely owned by Russian companies, will not conduct an anti-Russian foreign policy in the foreseeable future”.29

After Russia agreed to the Burgas-Alexandroupolis pipeline, talks with Turkey on Blue Stream II, an oil pipeline parallel to the Blue Stream gas pipeline running across the Black Sea, came to a halt. Turkey had become in Moscow’s eyes very similar to Ukraine and Belarus: it was a major transit country between Russia and its West European customers that had become an obstacle to be bypassed. As relatively smaller countries, Greece and Bulgaria were far less able to resist Russian pressure; and after their participation was confirmed, South Stream gained significant momentum.

Zeyno Baran, on her part notes that “Outside the EU, Serbia, another South Stream target along the middle of potential Black Sea-Western Europe pipeline routes, also came under Russian manipulation and political pressure. Russia greatly benefited from the EU/US tension with Serbia over Kosovo’s declaration of independence. Moscow strongly opposed independence for Pristina, a position that was viewed in Belgrade as critically important to Serbia. With the West’s focus drawn rather narrowly to Kosovo, Russia was able to offer a broad package deal that convinced the Serbian leadership to sign onto the South Stream project”. In addition, “Moscow succeeded in exploiting Serbia’s fears of being isolated in order to extract as many concessions on energy as it could. These concessions will have lasting effects; even after Serbia becomes part of the European and Euro-Atlantic structures, Russia will continue to have significant influence over Belgrade’s domestic and foreign policy”.30

As much as particular countries along the scheduled passage of South Stream or Nabucco are important for both projects realization, the feasibility of both projects depends on their potential to attract enough gas resources so as to be financially viable. Many analysts doubt Moscow’s effective possibility to feed both North and South Stream gas pipelines with its own resources. That is probably the reason behind the signing of the Prikaspiisky Pacts.

On the other hand, Azerbaijan is the closest gas-rich market to Europe, and is the US energy strategy’s main focal point. In November 2007, the Azerbaijani government and the Western producers operating in its Shah Deniz offshore gas fields announced that there were significantly more reserves than initially thought—enough to supply the first phase of the Nabucco project. Yet, given price disputes with Turkey and lack of political will from the European countries, the Azerbaijani government did not increase production in time to make Nabucco’s scheduled start. Since the project’s start date is likely to be delayed, if and when there is a clear commitment from the ΕU to Nabucco, production can take off. But not for long, as Azerbaijan’s gas reserves are not sufficient for supplying feasible volumes to Nabucco project in later production stages.

On the eastern part of the Caspian, Kazakhstan and Uzbekistan have significant gas that can be exported, and Turkmenistan is believed to possess some of the largest gas fields in the world. This will help reduce uncertainty among potential Nabucco investors and will alleviate some doubt as to the pipeline’s feasibility. Another positive development for the Caspian-EU gas corridor is the warming of relations between Azerbaijan and Turkmenistan. In March 2008, Ashgabat reopened its embassy in Baku after a seven year absence. The two countries held a number of the highest level bilateral meetings and reached sufficient common understanding.

A further encouraging development is the increasing attention the EU has given to Central Asia. In April the EU Troika made their third visit to Central Asia, meeting in Ashgabat the foreign ministers of the five nations. Shortly after this meeting, Ashgabat announced that it would be able to provide 10 bcm per year to Europe, and also declared that it would prefer to export this gas via non-Russian-controlled routes.

Conclusion

In real terms, Europe is competing with China for Central Asian energy supplies. Europe is in fact hoping to get Russia to feed the Nabucco pipeline project, since Russian gas already reaches Turkey – Nabucco’s hub – via the Blue Stream pipeline, and the Russian Gazprom holds a 50% stake in the Baumgarten gas hub in Austria, Nabucco’s destination. If Nabucco is indeed destined to become a Russian–European project, Moscow would have even less interest in robustly developing China as an alternative market for its energy exports. The North Stream, South Stream and Nabucco would be far too much for its exporting capacities.

In reality, it seems not a mere coincidence at all, that Moscow waged in August 2008 the war in Georgia after the EU’s two main countries, Germany and France, refused to sign in favor of Ukrainian and Georgian membership in NATO (NATO summit, Bucharest, April 2008). In fact, the stance that European countries adopt will become a determinant of Russian energy policies. China, therefore, has every reason to probe how these equations are affected by the crisis in the Caucasus. It is also true that Beijing will be the sole beneficiary if another Berlin Wall were to appear in the eastern Polish frontier with Ukraine.

[1] Cornell, Svante E. and Nilsson, Niklas (eds.), “Europe’s Energy Security: Gazprom’s Dominance and Caspian Supply Alternatives”, Central Asia-Caucasus Institute & Silk Road Studies Program, p. 10

2 Blagov, Sergei, “Russia Registers Significant Victory in Caspian Basin Energy Contest”, in: Eurasia Insight, May 4, 2006, http://www.eurasianet.org/departments/insight/articles/eav050208.shtml.

3 “Russia, Kazakhstan Agree to Double Pipeline Capacity by 2012”, RIA Novosti, May 7, 2008, http://en.rian.ru/business/20080507/106846493.html

4 “Russian, Kazakh Leaders Sign Accords”, Calgary Herald, May 23, 2008, http://www.canada.com/calgaryherald/news/calgarybusiness/story.html?id=a8b68a8f-1ccb-4f8d-88e8-b5150b458d92&k=89570.

5 Weitz, Richard, “Kazakhstan and the New International Politics of Eurasia”, Central Asia-Caucasus Institute & Silk Road Studies Program, Silk Road Paper, July 2008, p. 119

6 Weitz, Richard, “Kazakhstan and the New International Politics of Eurasia”, Central Asia-Caucasus Institute & Silk Road Studies Program, Silk Road Paper, July 2008, p. 129

7 Weitz, Richard, ibid, p. 109

8 .Pryde, Ian, “Another Big Player for a Neighbor”, in: Eurasia Insight, March 23, 2006,

http://www.eurasianet.org/departments/business/articles/pp032306.shtml

9 “New Rebuff for China on Kazakh Oil”, New York Times, May 17, 2003,

http://query.nytimes.com/gst/fullpage.html?res=9B05E0DD143EF934A25756C0A9659C8B63

10 “Courting Kazakhstan”, in: Eurasia Security Watch, July 7, 2005,

http://www.afpc.org/esw/esw93.shtml

11 XFN-ASIA, “China, Kazakhstan Agree on Sino-Kazakh Oil Pipeline Extension to Caspian Sea”, Kazakhstan’s News Bulletin, August 20, 2007,

http://www.kazakhembus.com/NB4-200807.html

12 Zheng, Lifei, “China, Kazakhstan Build on a Solid Foundation”, China Daily, October 15, 2007, http://french.10thnpc.org.cn/english/international/228117.htm.

13 “China-Kazakhstan Pipeline Starts to Pump Oil”, China Daily, December 15, 2005,

http://www.chinadaily.com.cn/english/doc/2005.12/15/content_503709.htm.

14 Cornell, Svante; Johnson, Anna; Nilson, Niklas; Haggstrom, Per, “The Wider Black Sea Region: An Emerging Hub in European Security”, in: “Europe’s Energy Security: Role of the Black Sea Region”, (Central Asia – Caucasus Institute: Silk Road Studies Program, 2006), p. 80

15 Ibid, p. 81

16 Socor, Vladimir, “Seven Russian Challenges to the West’s Energy Security”, in: Eurasia Daily Monitor, 6 September 2006.

17 Bombay, Daniel – Buckley, Neil – Hoyos, Carola, “Nato Fears Russian Plans for “Gas Opec”’ Financial Times, November 14, 2006.

18 Socor, Vladimir, “Trans-Black Sea Pipeline Can Bring Caspian Gas to Europe”, in: Eurasia Daily Monitor, 7 December 2006

19 Dempsey, Judy, “Gazprom’s Grip on Western Europe Tightens with Pipelines to Hungary”, International Herald Tribune, June 22, 2006

20 Socor, Vladimir, “South Stream: Gazprom’s New Mega Project”, Jamestown Foundation, Washington, D.C., Vol. 4, Issue 123, June 25, 2007.

21 Socor, Vladimir, “South Stream: Gazprom’s New Mega Project”, Jamestown Foundation, Washington, D.C., Vol. 4, Issue 123, June 25, 2007.

22 Tsakiris, Theodoros, “I geopolitiki proistoria ton energeiakon antiparatheseon HPA – Rosias stin Evropi kai i stratigikh simasia tou roso-boulgarikou-ellino-italikou agogou” (The Geopolitical Pre-history in the Russian – US Energy Disputes and the Strategic Importance of the Russian-Bulgarian-Greek-Italian Gas Pipeline (South Stream), (Athens: Hellenic Centre for European Studies (EKEM), 2007), p. 5

23 Stern, Jonathan, “The New Security Environment for European Gas: Worsening Geopolitics and Increasing Global Competition for LNG”, Oxford Institute for Energy Studies, Natural Gas Series #15, October 2006, p. 7

24 Blagov, Sergei, “Russia Celebrates its Central Asian Energy Coup”, May 5, 2007 www.eurasianet.org/departments/insight/articles/eav051607_pr.shtml

25 Tarkas, Alexandros, “Singrousi HPA-Rosias gia opla kai energia stin Ellada” (US-Russia dispute over the wepons and energy resources issue in Greece), in: Amyna kai Diplomatia (Defense and Diplomacy Journal), April 2007, p. 14

26 Tarkas, Alexandros, “Singrousi HPA-Rosias gia opla kai energia stin Ellada” (US-Russia dispute over the wepons and energy resources issue in Greece), in: Amyna kai Diplomatia (Defense and Diplomacy Journal), April 2007, p. 14

27 Baran, Zeyno, “Security Aspects of the South Stream Project”, Center for Eurasian Policy, Hudson Institute, October 2008, p. 9

28 Baran, Zeyno, ibid, p. 9

29 Hill, Fiona, “Beyond Co-Dependency: European Reliance on Russian Energy”, in: U.S.-Europe Analysis Series, The Brookings Institution, Washington, D.C., July 2005, http://www.brookings.edu/papers/2005/07russia_hill.aspx.

30 Baran, Zeyno, “Security Aspects of the South Stream Project”, Center for Eurasian Policy, Hudson Institute, October 2008, p. 17